Avalanche (AVAX): An Innovative Consensus Protocol in DeFi

With the rising interest in cryptocurrency, there’s a race to make the most feature-rich blockchain. As a result, some impressive platforms have emerged in the past few years. One of these is the Avalanche Network (native token: AVAX).

Avalanche is an open-source platform for decentralized applications and financial primitives. Its developers aim to steer the market toward decentralized finance and build new foundations in the field.

How did the Avalanche network begin — and should you invest in it? Below, we discuss the Avalanche Foundation and AVAX in detail.

What Is Avalanche Crypto?

Avalanche is a decentralized platform that allows anyone to produce decentralized applications and multi-functional blockchains. Ava Labs designed this platform to minimize certain limitations of some of the “older” blockchains.

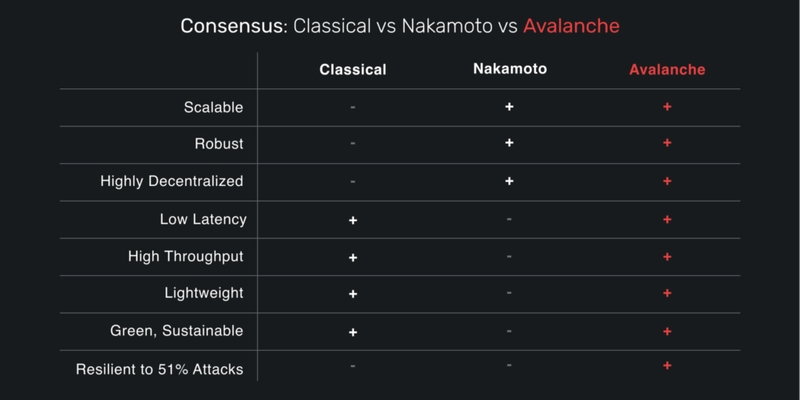

Some of these limitations include centralization, lack of scalability, and slow transaction speeds. The platform’s native Avalanche consensus protocol offers high throughput, low latency and resistance to attacks in order to eliminate these issues.

The Avalanche mainnet was launched in September 2020. Its developers raised $42 million only two months ago in a successful native token sale. All 72 million of the Avalanche tokens sold out in under five hours. The investors are from over 100 countries around the globe.

Therefore, it was almost a given that Avalanche would be a popular project in the coming year, with such a phenomenal response to its ICO. The president of Ava Labs, John Wu, commented, “The success and velocity of the Avalanche sale is a testament to the quality of our project, and the impact it can have on both institutional and decentralized finance.”

Many previous crypto assets, notably Bitcoin, rely on a Proof-of-Work (PoW) consensus, with its extended confirmation times during which users have to wait for a new block to be created by the miners.

In contrast, Avalanche features a heterogeneous network on which several validator sets and blockchains are present to offer the same security standard as Ethereum or Bitcoin, but in a shorter time span.

The Avalanche network aims to take on Wall Street’s traditional role of building new finance foundations, thereby offering users a platform that’s secure and scalable.

What Is AVAX?

Avalanche’s native token is called AVAX. It secures the Avalanche network via staking. Token holders can use it to pay fees and conduct peer-to-peer transactions.

The demand for AVAX comes from different sources:

- Avalanche uses AVAX to transfer value at scale and speed.

- Users can earn AVAX tokens to generate passive income by staking them, or by setting up a validator.

- The Avalanche platform allows open financing for assets such as stablecoins. The use of AVAX is required to create subnetworks and digital assets.

Validators will not lose the AVAX tokens, which are the staked assets, since these tokens don’t act as collateral. As a result, validators have a lower risk of losing money. This particular feature of AVAX makes it different from Ethereum and other cryptocurrency platforms.

In addition, the Avalanche network encourages participation and incorporates predictability in staking.

AVAX is also used to pay for fees on the network. Just as with the Nakamoto consensus, the tokens don’t go to validators or miners. Instead, they’re burnt to ensure that the whole ecosystem is benefiting, rather than just a few players.

Who Founded AVAX?

Ava Labs created the AVAX token, Avalanche network and the novel consensus protocol made by “Team Rocket” which aims to revolutionize the classical consensus protocols and Nakamoto consensus. A professor at Cornell University, Emin Gün Sirer, formed Ava Labs along with two computer science PhDs, Maofan “Ted” Yin and Kevin Sekniqi.

Sirer attended Princeton University on scholarship. He earned his PhD in Computer Science and Engineering from Princeton in 2000 and became an assistant professional at Cornell University the next year.

His first attempt at starting a cryptocurrency was in 2002–2003 when he created a peer-to-peer virtual currency, Karma, with Sangeeth Chandrakumar and Vivek Vishnumurthy. Karma was created six years before Bitcoin and was the first cryptocurrency to use a PoW minting process.

However, unlike Bitcoin, Karma didn’t combine the consensus protocol with the new supply’s minting. Also, Karma was introduced at an unfortunate time, right after 9/11. Funding was scarce, and there were security concerns regarding Karma’s peer-to-peer model of virtual currency.

Sirer assessed the decentralization of Ethereum and Bitcoin before the cryptocurrency market overheated in 2017. He recorded his findings in 2018, remarking that further research was required to decentralize the consensus protocols.

After presenting a paper at the Genesis London Conference in 2018, Sirer’s next step was the creation of Avalanche, often termed “Blockchain 3.0” since it improves on its predecessors.

How Does Avalanche Work?

The working mechanism of Avalanche is different from former blockchains and other similar platforms. It has three interoperable blockchains: a Platform Chain, a Contract Chain and an Exchange Chain.

The Exchange Chain, or X-Chain, helps create and trade new crypto assets. Meanwhile, the C-Chain is the Ethereum virtual machine implementation of Avalanche, enabling the creation of smart contracts. Finally, the P-Chain tracks and creates subnets and coordinates validators.

The Snowman mechanism secures the C-Chain and P-Chain, enabling smart contracts with high throughput, whereas the DAG-optimized Avalanche consensus secures the X-Chain. The Avalanche consensus protocol allows transaction finality in just a few seconds.

Since the Avalanche network’s architecture is split across three blockchains, the network is well-optimized for security, speed and flexibility. Thus, it is a robust platform for enterprise and individual use, as developers can flexibly build different applications.

AVAX, the native token in the Avalanche ecosystem, is used for staking and paying network fees. What makes Avalanche so unique is that it can handle significantly more transactions than many other blockchains. In fact, it can handle 4,500 transactions per second, compared to only 15 TPS on Ethereum and 7 TPS on Bitcoin.

Bitcoin - 7 transactions per second

Ethereum - 15 transactions per second

PayPal - 193 transactions per second

Ripple - 1500 transactions per second

VISA - 1700 transactions per second

Avalanche - 4500 transactions per second

Also, it gets to transaction finality in just three seconds or less. This makes it a much better option for bringing scalability to decentralized applications.

Along with being more scalable than other blockchains, Avalanche is also interoperable.

It achieves this interoperability by enabling blockchains between or within a subnet to facilitate communication. Thus, these can be complementary, while supporting cross-chain value transfers.

Avalanche is also more inclusive than other Proof of Stake blockchains which only allow a certain number of validators. Anyone who stakes at least 2,000 AVAX can participate in Avalanche network consensus.

Although Avalanche supports the Ethereum Virtual Machine, the ecosystem doesn’t use the same consensus mechanism as the Ethereum network.

Avalanche Subnets

Avalanche’s architecture includes subnetworks or subnets. They are similar to sharding on Ethereum 2.0. You can think of subnets as the clone of a default blockchain. A subnet is a set of validators that work together to achieve consensus.

In a subnet, validators may be required to have the following features:

- Be in a certain country

- Pass KYC/AML checks

- Have a specific license

The network’s architecture also supports private subnets where only predefined validators can join. Thus, the blockchain’s contents will only be visible to these validators. The private subnets are ideal for organizations that want to keep their data confidential.

Users can create subnets on-demand and according to their specifications. As previously mentioned, a subnet could launch another subnet upon temporary exhaustion of its scaling limits to fulfil the network demands while effectively increasing the number of transactions.

The unlimited range for subnet creation on Avalanche shows how it can resolve scalability issues of conventional blockchains. All subnets must be a validator for the Primary Network chain as well as their own blockchain, and each subnet must be a Primary Network member (2,000 AVAX) for validating the Primary Network.

Here is a brief overview of how Avalanche’s architecture works: the primary network validates the built-in blockchains on Avalanche. The P-Chain coordinates validators, creates subnets and uses the Snowman Consensus Protocol, which enables self-executing smart contracts on the network.

Within this protocol, the X-Chain creates assets, exchanges assets and uses the Avalanche consensus protocol. The C-Chain runs executive EVM contracts and uses the Snowman consensus protocol.

The Consensus Mechanism

Credit: Avalanche whitepaperThe Avalanche consensus protocol has three mechanisms that give structural support to the network. These are the non-BFT protocol (Slush) that progressively built up to Snowflake and Snowball. These are single-decree consensus protocols with increasing robustness and are all based on the common majority-based metastable voting mechanism.

According to Ava Labs’ whitepaper, “Inspired by gossip algorithms, this new family gains its safety through a deliberately metastable mechanism. Specifically, the system operates by repeatedly sampling the network at random and steering the correct nodes towards the same outcome. Analysis shows that metastability is a powerful, albeit non-universal, technique: it can move a large network to an irreversible state quickly. However, it is not always guaranteed to do so.”

Credit: Avalanche whitepaperIn gossip algorithms, the connected nodes are randomly sampled to receive information. The Avalanche consensus protocol takes inspiration from this algorithm as it subsamples nodes to achieve consensus.

Let’s explain this with an example. Suppose there’s a network where the nodes have to select between two numbers, such as four and five. A node in this network will randomly pick several nodes and ask them to choose a number.

All of these selected nodes will send back a response with their chosen number. With this response, the node that posed the question initially would know which number the network is leaning toward.

Subsequently, all in-network nodes will undergo this process to achieve a consensus in the network. If there’s a tie between both options in the first voting round, the network will have a second round of voting in which the likelihood of a tie will be lower.

With every round of voting, the probability keeps reducing. This feature of the network is called metastability, which means the network will eventually land on a single choice.

The entire purpose of achieving a consensus within the network is to ensure that the nodes agree with each other and that there’s no “tie.”

As each round of voting comes to an end, the network begins to determine the final number more rapidly. Once all nodes come to a consensus, the network will achieve a finality. In Avalanche, this happens in a matter of seconds.

Avalanche Bridge Technology

At the beginning of 2021, Avalanche launched the Avalanche Ethereum Bridge. Just a few months later, the developers launched the aptly named Avalanche Bridge, making transaction fees five times cheaper and enhancing cross-chain interoperability.

According to the developers, the Avalanche Bridge has been designed to:

- Ensure that users have access to security-first technologies

- Cut the cost of bridging assets, making it as low as possible

- Speed up transactions

- Increase transparency so that users can be fully informed every step of the way

- Make crypto assets intuitive so that new users can easily understand how to use the bridge

- Support the ecosystem so that users understand how capable the Avalanche ecosystem is after they’ve crossed the bridge

- Allow users to seize opportunities with minimal friction in understanding the scope of the Avalanche ecosystem

- Support blockchains and make Avalanche the hub of decentralized finance (DeFi)

Core

Ava Labs recently released Core, a non-custodial, hot wallet, browser extension for users to seamlessly and securely navigate the Avalanche ecosystem. Core is more than just a wallet, it's an all-in-one operating system bringing together Avalanche apps, Subnets, bridges, and NFTs in one seamless browser experience.

Core welcomes new users from the Bitcoin community, who can now deploy BTC across Avalanche’s DeFi ecosystem. In the future, Core will connect users to Avalanche Subnets, Ethereum, and other blockchain networks. Over the last month, the Avalanche Bridge has seen almost $45 million worth of Bitcoin bridged natively to Avalanche.

Credit: Avalanche Medium

Core highlights a few key features including:

1. Bridge

Bridging native Bitcoin using the same technology as Avalanche Bridge.

2. Swap

Swap AVAX tokens directly from Core, powered by ParaSwap.

3. Buy

On-ramp directly with Core in just a few clicks, powered by MoonPay.

4. Wallet Compatibility

Compatible with hardware wallets like Ledger and Trezor

5. Portfolio

View all assets in one display without manually adding token addresses or switching networks.

6. NFT Gallery

Manage and display all of your favourite NFTs in one place.

7. Subnet Support

Native support for subnets including DFK and Swimmer with dynamic support forthcoming.

8. Address Book

Create contacts to save frequently used and trusted addresses.

9. Account Switcher

Create and manage multiple addresses using the same recovery phrase (similar to MetaMask).

Demand for AVAX

AVAX acts as the gas token for payments on the Avalanche platform. It’s used to collect transaction fees. Users can stake their AVAX to earn rewards as a form of passive income.

Currently, there’s a total supply of 720 million AVAX, half of which were produced in the Genesis Block. The other half, according to the whitepaper, will be released per an emission curve.

The Avalanche community consensus can change the release date for the token, but it won’t change the circulating supply. While the TVL on Avalanche has decreased significantly in the past few months, there have been active developments in their ecosystem.

In August 2021, Avalanche announced the release of Avalanche Rush, a $180 million incentive program for liquidity mining. The program, launched in collaboration with Curve and Aave, drove a massive amount of total value locked (TVL) into various decentralized applications (DApp) on Avalanche’s growing DeFi platform. At its peak, there was over $24.01 billion of TVL on Avalanche, showing clear evidence of ecosystem growth.

Following that, the Avalanche Foundation announced a $220 million ecosystem fund called Blizzard dedicated to accelerating development, growth, and innovation across the ecosystem of builders and users of the Avalanche public blockchain and beyond.

The fund focuses on four key areas of growth across the ecosystem: DeFi, enterprise applications, NFTs and culture applications, and will also look for opportunities to support other emerging use cases such as security token issuances, liquidity providers and self-sovereign identity.

The Blizzard fund should play a key role in growing the Avalanche ecosystem and attracting all sorts of new protocol development. While fees on Ethereum remain high, Avalanche should be able to steal market share from Ethereum users who are sick of having to decide whether they can afford to make a transaction or not.

Avalanche (AVAX) Price Predictions

The price of AVAX is currently trading at $23.55. At the time of this writing, the cryptocurrency is the 14th largest by market cap. Although the technicals show that the token is in the “buy” spectrum, you might want to consider the current market conditions which could just be a relief rally at the moment.

According to different experts, the sentiment around AVAX has recently turned positive but remains slightly negative for the next few years. Wallet Investors expect AVAX to hover around $51.95 based on their forecast of the current market trend.

Digitalcoin estimates thatofficial Avalanche wallet would trade at around $$48.47 in 2025, while the lowest is forecast at $43.37. They also regard AVAX as a wise investment and expect its price will increase according to their predicted data.

Similarly, experts at Long Forecast think that AVAX could likely trade between $44.50 and $51.20 in 2025, which is still a long way down (-65.1%) from its previous all time highs of $146.22 in November 2021.

While the crypto asset’s price is forecasted to trade range bound this year, experts are certain that AVAX could see a long-term positive price increase once we break out of the bear market.

Where to keep your AVAX

There are plenty of places for you to store your AVAX and other Avalanche assets. The type of wallet you choose will likely depend on what you want to use it for and how much you need to store.

Hardware wallets or cold wallets like Ledger or Trezor provide the most secure option for storing cryptocurrencies with offline storage and backup. However, they can require more technical knowledge and are a more expensive option. As such, they may be better suited to storing larger amounts of AVAX for more experienced users.

You can also store your AVAX on Metamask which is a hot wallet that is easier to set up and use compared to a cold wallet, but is less secure.

As previously mentioned, Core is also an all-in-one non-custodial browser wallet that can be easily created for you to store your Avalanche assets. Alternatively, AVAX can be safely stored in the official Avalanche wallet. Their official wallet is available to download on mobile or desktop and can be custodial or non-custodial.

With custodial wallets, the private keys are managed and backed up on your behalf by the service provider. Non-custodial wallets make use of secure elements on your device to store your private keys. While convenient, they are seen as less secure than hardware wallets and may be better suited to smaller amounts of AVAX or more novice users.

Avalanche vs. Solana: How Are They Different?

Scalability is one of the main issues many blockchains trying to resolve. Obviously many blockchains like Polygon, Cosmos, Polkadot and Solana are competing with each other to address the issue, still, they all have a different approach.

For one, Avalanche differentiates itself from the DAG-optimized consensus mechanism. The blockchain claims to have over 4,500 transactions per second (TPS) with less than two seconds of transactional finality relying on thousands of nodes to validate the transaction. Still, Solana’s Proof of History allegedly claims to handle over 1000% more TPS than Avalanche.

Since finality guarantees the immutability of cryptocurrency transactions, it is critical to decide which blockchain is more susceptible to the public’s adoption. As mentioned above, the average finality for Avalanche is around two seconds, whereas Solana claims to have finality in 500ms. Thus, the network appears to be faster for users.

Avalanche has about an 80% parameterized safety threshold that is comparably higher than other blockchains. The know your customer (KYC) process is unique in which a validator’s identity needs to be inspected and verified to minimize the chances for a group or entity from gaming the network.

However, you can have one subnet requiring high validator requirements with Avalanche. Thus, it leverages GPU processing to avoid slowing down. On the other hand, Solana tries catering to each use case, making developers compromise.

Limitations of Avalanche

While Avalanche has many benefits to rave about - from permissionless smart contracts to staking rewards, the platform has its limitations.

One of them is the issue of decentralization. Ava Labs has 10% of the total token supply of AVAX, or 72 million. Distributing these tokens so that the platform is decentralized sufficiently, with none of the nodes having more than 1% of the network, is a challenge.

Moreover, if the in-network nodes disagree, the Avalanche consensus protocols don’t perform as efficiently. The developers are trying to address this by means of the Frosty consensus, which creates a “leader” node to improve performance when there’s a block contention.

However, these limitations likely won’t be a problem for long, as the developers take active steps to improve scaling and decentralization on the Avalanche blockchain.

Final Note

With utilities such as smart contracts and transaction finality in seconds, Avalanche has become a hit. Although it’s been in the market for less than a year, it’s been moving quite quickly, releasing new features one after another.

The Apricot Upgrade has improved many aspects of the network. That includes verifiable pruning, which allows nodes to be online for a fraction of the current time, alongside freezing and unfreezing functions that token issuers can utilize.

But the hype and improvements surrounding the network are useless if participants don’t stick around for the long haul. Experts at Forbes have similar sentiments: “The thought that’s on our mind is if Avalanche and the community there can convert this influx of new Avalanche users into long-term participants in the network’s DeFi ecosystem.”

Therefore, it will be interesting to see in the coming months whether the users stick to the network or not.

Sign Up With Bybit and Get AVAX NowGrab Up to 5,000 USDT in Rewards

Get additional 50 USDT welcome gift instantly when you sign up today.